Looking Beneath the Surface: A Primer on Underground Storage Tank Trust Funds

Could a state-supported underground storage tank (UST) trust fund offer relief for cleanup costs on your property? We address some common questions about these varied and sometimes confusing environmental “insurance policies”.

What are UST Trust Funds?

Underground Storage Tank (UST) Trust Funds, also known as UST Financial Assurance Funds have been established in most states first and foremost to provide financial assurance by serving as insurance policies for UST owners to cover potential costs and damages associated with large scale contamination from USTs.

Federal and state laws require UST owners to demonstrate that they have the financial means to pay for environmental cleanup associated with UST leaks, including investigation, contamination cleanup, replacing contaminated drinking water supplies and even paying third party damages. Trust funds are there to help eligible property owners meet these financial requirements (which, while varying by state, amount to millions of dollars) without purchasing additional insurance.

These funds are also used to reimburse property owners for actual costs associated with assessing and cleaning up soil and groundwater that has been contaminated by a release of petroleum from a UST on their property.

To be eligible for reimbursement from a trust fund, a property owner must demonstrate that he/she is in substantial compliance with the environmental regulatory standard established for land owners with USTs on their properties.

What is the specific standard?

The federal regulation, established and overseen by the U.S Environmental Protection Agency (EPA), is Title 40 CFR (Code of Federal Regulations) Part 280 —Technical Standards and Corrective Action Requirements for Owners and Operators of Underground Storage Tanks.

Are the requirements meeting it the same in every state?

While the federal standard is the same nationwide, each state has a slightly different definition of “substantial compliance”; some states have stricter requirements, others more lenient. To achieve accreditation, each state program must meet or exceed an established federal standard.

Which states offer these UST Trust Funds?

According to the EPA, 36 states currently have UST Trust Funds that assist with both newly identified and past petroleum releases from USTs.

Five states offer “phased out funds,” paying only for ongoing cleanups identified prior to a specific date and not for releases identified after that date. Nine states, five U.S. territories and the District of Columbia do not offer UST Trust Funds. Instead, they rely on EPA-approved, privately-funded mechanisms to finance cleanups.

View the EPA map detailing which states offer which coverage here.

Under what circumstances might a property owner seek financial relief from a state UST fund?

The most common trigger for an application for financial assistance is some sort of unusual operating condition on the property. Conditions include equipment problems (signaled by the failure of a line or tank test), a drop in petroleum product volume in a tank, or a vapor release.

When a petroleum release into soil or groundwater is suspected, it is the property owner’s responsibility to report the unusual operating condition within the state’s timeframe, investigate the situation, and relay the findings to the state’s environmental regulatory agency.

In most cases the state agency has a procedure for gathering and analyzing the data needed to confirm the release. Once it is determined that the site is eligible, the owner can request funding.

What’s the process to request and receive funding?

Again, each state’s process is different. But in general, an owner must make a formal application to the state’s trust fund administrator for reimbursement. In some states, like Mississippi, a site visit by state regulators is also required.

One critical factor to consider is your state’s timetable for reporting a release. In Tennessee, for example, once an owner obtains evidence of a release, he or she has 72 hours to confirm the release. In Michigan, notification confirming a release must be made within 24 hours.

Some states have established schedules detailing the types of expenditures eligible for reimbursement, maximum reimbursement amounts, and requirements for follow-up audits on the property. Most states also provide a list of approved contractors to handle UST release cleanups from which a property owner must choose.

Do UST trust funds cover all of the costs associated with assessment and cleanup?

Like insurance policies, these funds require property owners to pay a deductible. Deductibles vary by state. Some specify a dollar amount (in Ohio, $11,000 for six or fewer tanks; $55,000 for seven or more), while others require owners to pay a percentage of cleanup costs.

Are their limitations on how the funds can be used?

Funds must be used for activities related to the cleanup of either ongoing or newly-reported releases. Activities commonly covered include the recovery of leaked fuels, the cleanup of contaminated surface or ground water, excavation to remove contaminated soil and many more steps specified by each state. Details on the activities covered (and not covered) are available from each state’s trust fund administrative agency.

Are functioning gas stations the only properties eligible for UST fund reimbursement?

No. These funds are maintained to assist not only the petroleum-user industry, but owners of properties with non-functioning USTs as well.

Former gas stations or fuel-related businesses that have subsequently been redeveloped for other purposes may have legacy USTs with the potential to release fuel into the ground or water. Owners of these redeveloped properties can also apply for UST trust fund reimbursement for cleanups.

Don’t redeveloped properties like former gas stations qualify for support from brownfield redevelopment funds?

Yes, but the two funding sources serve two different purposes. A site could have USTs in one area of the property and PCB contamination in another. UST trust funds could support the cleanup of the former, brownfield redevelopment funds the latter.

What are the specifics of my state’s fund?

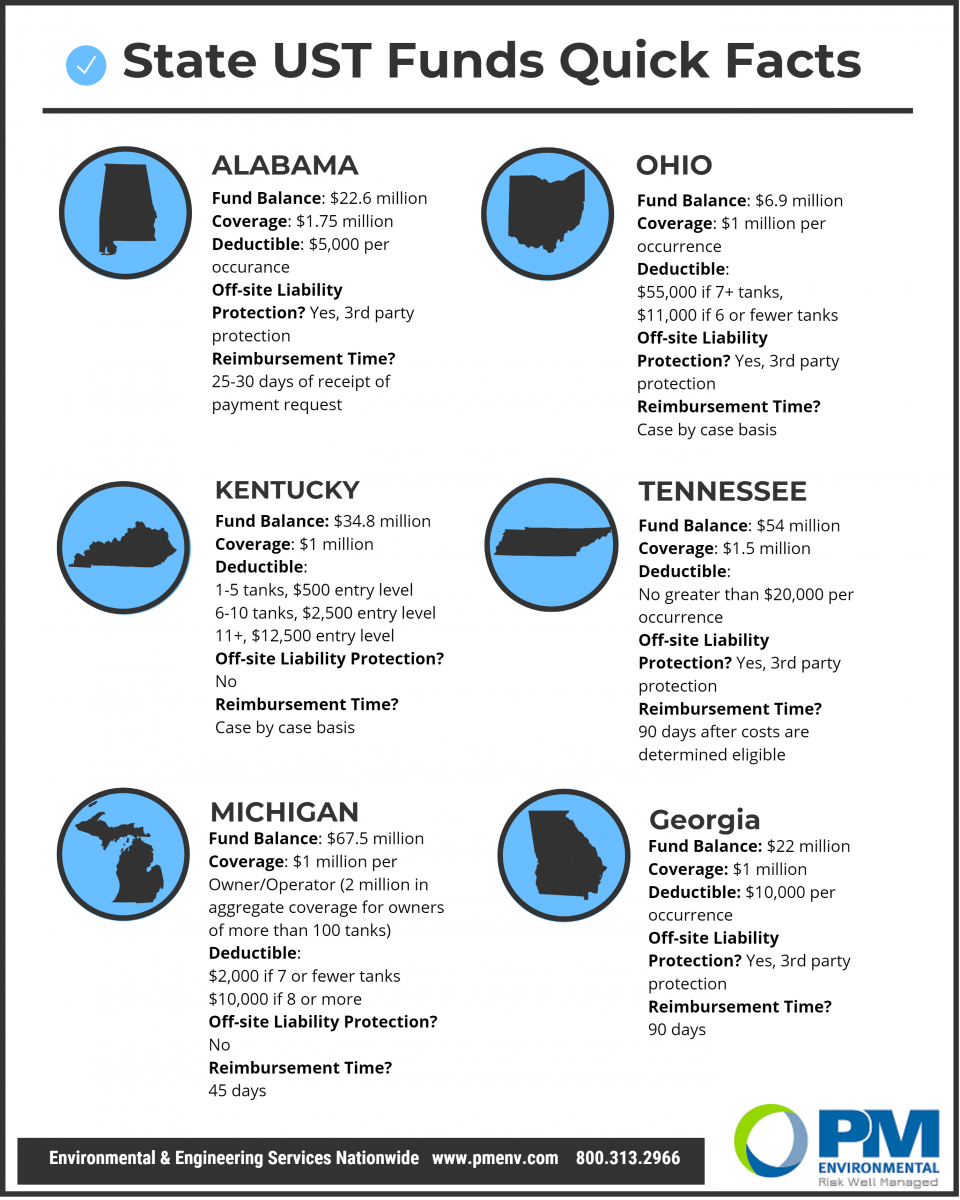

The graphic to the right provides details about UST trust funds in in Michigan, Ohio, Tennessee, Alabama, Mississippi, Kentucky and Georgia, including the balance of available dollars in each. While PM Environmental is available to help property owners anywhere in the U.S., our dedicated teams are actively navigating UST trust funds in these states.

How can I be sure I receive the maximum reimbursement I’m entitled to?

A UST trust fund is an insurance policy to manage risk. So is the right environmental consultant. PM Environmental is experienced in developing and executing customized risk management solutions for clients in a wide variety of business segments.

We have knowledge and expertise to navigate the ins and outs of any state’s UST trust fund, not just for petroleum operators, but for any business sited on property with legacy USTs. Our reputation has helped us build strong relationships with state UST administrators and case managers. Our clients rely on PM to streamline compliance and reimbursement, bridging gaps others simply can’t overcome. Contact us today to learn more.

PM Environmental contributors to this article include Mike Kulka, Curt Lichy and Greg Stephenson.